KELA

KELA’s, the Social Insurance Institution of Finland, purpose is to implement the Finnish social security system and they offer therefore services in a wide range of life situations. The aim of the social security system in Finland is to secure an adequate standard of living in all walks of life. In the past I have received financial aid for students as well as housing allowance to live on my own while studying. For my current studies, however, I am receiving adult education allowance, which is not one of KELA’s services, but I do need to pay the student healthcare fee for higher education to KELA, nonetheless. In addition to studying, I am taking care of my 2-year-old daughter. This means that we have received the maternity package provided by KELA and she gets paid child benefit monthly. I am also eligible for the child home care allowance now that I am no longer receiving pregnancy or parental allowances. Since my daughter was quite sick during her first year of life, we were also eligible for the disability allowance and were reimbursed for medical expenses and medication. In regard to my own health, I have made sure that I am covered also while traveling by getting the European health care card. My family and I obviously all also have our own Kela cards.

OmaKanta

I typed in www.kanta.fi to my browser and klicked on “Log in to MyKanta” from their website. This way I know that I am entering the legitimate site and not some fraudulent website through google. After that I am required to identify myself through bank-ID identification. Once identification is complete, I can continue to the service. In OmaKanta I can check my daughter’s and my own health data and prescriptions. I have utilized OmaKanta to for example print out a COVID-19 certificate and renew a prescription.

KEVA

According to KEVA my general retirement age for old-age pension is still to be confirmed since I am born after 1965. The same goes for my upper age limit at which pension accrues. Pension starts to accrue at the age of 17 and annual accrual rate is 1.5%. However, if you continue working after your eligibility for old-age pension starts, a deferment increase of 0.4% will be added to the pension monthly. This increase will continue until your actual time of retirement. Keva does not have my pension information, so I am unable to get an estimate of the amounts at 63 and 68 years old. Nonetheless, the difference can be calculated by adding up the 1.5% accrual for the extra 5 years and the potential monthly deferment increase.

Booking.com

I decided to visit booking.com because it is a service I use when booking accommodation abroad. Although I have used it before, I have not paid attention to or looked up prices via different sites to see if the website’s pricing is reliable. I was curious to see if for booking.com, like for many other digital shops involved in the traveling business, the prices change according to how many times you have searched with the same search criteria. I decided to focus my search on hotels in my hometown of Turku for the upcoming weekend. Since I was automatically logged in on booking.com, the website claimed to have a Secret Deal for me as I am an account holder. The offer was for a two-night stay in a Standard room at Radisson Blu Marina Palace Hotel. The price was 306€ for two people including breakfast and with no cancellation right. The price through the Radisson website with the same specifications was 309.6€. So, there is a minor advantage booking through the booking.com website but I would hardly call a 3.6€ saving a Secret Deal. Especially considering that if you were to become a member of the Radisson Hotels you would be able to knock off 19% of the price on their website. Additionally, when I logged out of booking.com the price for the room went up to 310€ which means that my secret deal as an account holder was a whopping 4 euros. I did the same check for two other hotels, Solo Sokos Hotel Turun Seurahuone and Scandic Julia, and for both the price on booking.com was the same as on the hotel website. I looked up the prices on two separate days to see if the price would change since I was looking with the same search criteria, but it did not. Therefore, I would conclude that the pricing on the booking.com website is accurate and reliable. Also, whenever I have used the website, I have always gotten the services and accommodation that I have paid for, so I would say that the website is reliable in that aspect also.

Danske Bank Mobile Banking

Since I work as a financial analyst, I decided to take a look at the Danske Bank Mobile Banking application. On their own website Danske Bank describes their Mobile Banking service in the following way: “Manage your banking easily and quickly using your smart phone or tablet when it is the most convenient for you. You can check the balance of your account, transfer money between your accounts or pay invoices – while you are on the go.” I chose this application because most finance applications require you to have an account in the bank or have some investments etc. in order to use it so it would be difficult to get a user experience if it wasn’t an app I was already using.

The services on the application that I use frequently are checking my balances, transferring money, and paying invoices. One shortcoming that I have noticed with the app is that it does not let you create electronic invoicing contracts but instead you need to use the eBanking service for that. However, creating those contracts is a rare occasion so it has not hindered my user experience greatly. The other main features on the application are investments, loans, and cards. Since I do not invest, I cannot speak for the user experience for that service. For loans I am able to look at the outstanding amounts and payments made towards that loan as well as read the loan contracts. The only shortcoming I have noticed in this regard is the fact that I was not able to check my interest rate reset date on the app but had to instead do that through the eBanking service. But again, a feature you rarely need so I understand why they left that out. I have never tried to request a moratorium or change the terms of the loan in some other way so I cannot say for sure whether that would be possible on the application, but I would imagine not. At least, I was not able to find an option for that easily on the app. The only service I have used regarding cards is the option to limit where abroad they can be used. In addition to that I would be able e.g. close the cards and set spending limits. I have not noticed any shortcomings in this area. All in all, I have been very happy with the user experience on the Danske Bank Mobile Banking application and it caters well to all my daily banking needs which is what it is meant for.

Digitalization and digital gap

While exploring the websites and applications listed above, I could not help but notice how easy it was for me. There isn’t really a situation or need that I can think of that I would not be able to handle on my own when it comes to digital services. The situation is very different for the older generation. If I use my parents as an example, I can think of at least three scenarios in which I have helped them out with digital services just within the past month. For example, I helped my mom set up Mobilepay on her phone and renew her Museum Card online. In addition, I helped my dad set up MTV Katsomo on his smart tv. For their generation it’s mostly an inconvenience when something changes or they need to set up something new but for people older than them, it could be an everyday struggle. All the examples listed above were also trivial inconveniences while the digital gap can have a great impact on the use of more important services like health care and banking.

The digital gap creates inequality not only through the differences in digital abilities but also through the differences in access to digital devices. When introducing digital services in e.g. the healthcare industry, we need to make sure that the older generation is being taken into consideration in order to promote equality across all generations. To make sure that digital services meet the needs of the many, people from all walks of life need to be included in the planning process. Also, we need to make sure that digital safety is being promoted since people might not be aware of all the dangers of the digital world. GDPR is a great step towards personal data protection but people need to be more conscious of that themselves also.

Further reading

If you wish to read more thoughts on this matte, you can check out the following entries from my fellow students. I left a comment on my thoughts on all three.

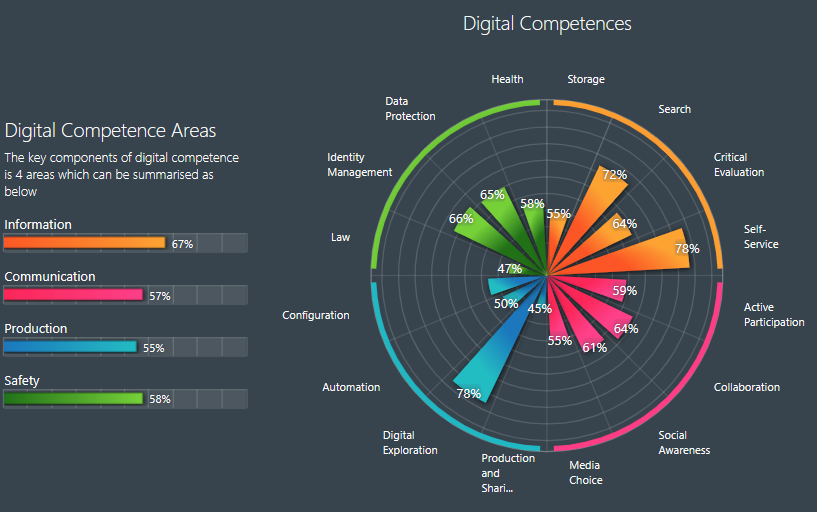

Digital competence test

Self-evaluation

What I learned from these assignments was to be grateful of the fact that I am a digi citizen. Many of the things I take for granted knowing are a struggle for others. Also, I had not familiarized myself with the pension system since it has seemed like such long ways away, so it was interesting to learn more about how pension is accrued. Kela and OmaKanta I was already quite familiar with from before, but it was eye opening to be reminded of all the services that are available to the Finnish people. These assignments also reminded me to take a more critical look at the websites I am using and making sure I compare and evaluate their reliability.